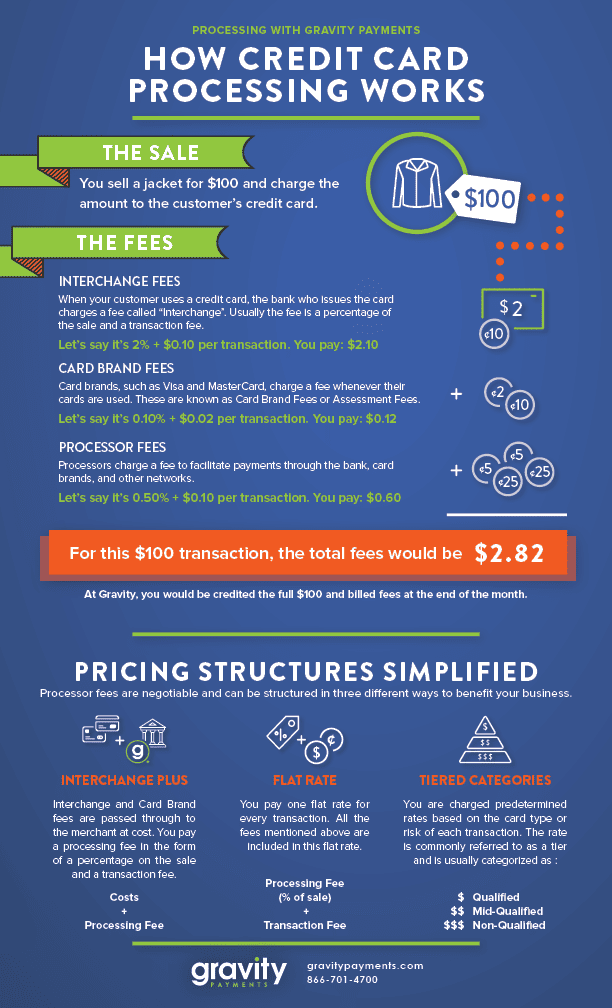

We get it. Credit card processing is complicated. That’s why we strive to make it as simple and seamless as possible. But, what does happen when you swipe a credit card at your favorite local business? Here’s a simple infographic breaking down the process for you.

The Sale

You sell a jacket for $100 and charge the amount to the customer’s credit card. Your customer swipes their card for a total of $100.

Total: $100

The Fees

The first thing that will happen is interchange fees will come out from the total transaction.

What are interchange fees?

When your customer uses a credit card, the bank who issues the card charges a fee called “interchange”. Usually, the fee is a percentage of the sale and transaction fee. Interchange is the portion of the processing cost that no credit card processor has control over. These rates are the same no matter where your merchant services account exists.

For this example, your interchange fee is 2% plus a $0.10 transaction fee.

You pay: $2.10.

Next, a card brand fee will come out from the total transaction.

What are card brand fees?

Card brands, such as Visa and MasterCard, charge a fee whenever their cards are used. These can also be known as Assessment Fees. Like all interchange fees, the card brand fees are not charged by Gravity Payments or any credit card processing company, but by the banks and card brands themselves. The credit card processor only collects the fees and passes them through to the card brand and bank.

For this example, the card brand fee is 0.10% + $0.02 per transaction.

You pay: $0.12

Finally, your payment processor will take out a fee to facilitate payments through the bank, card brands, and any other networks. Your pricing structure will vary depending on transaction size and volume. For this example, you’re charged 0.50% + $0.10 per transaction.

You pay: $0.60

For this $100 transaction, the total fees your business would pay is $2.82.

At Gravity, you would be credited the full $100 and billed the above fee of $2.82 at the end of the month.

How do credit card processors determine pricing structures?

Processor fees are negotiable and can be structured in three different ways to benefit your business.

Interchange Plus

Interchange and card brand fees are passed through to the merchant at cost. You pay a processing fee in the form of a percentage on the sale and a transaction fee. This is typically the most transparent form of processing. At Gravity, we’ll show you per transaction what you’re being charged. We’ll never hide anything in the fine print or make you pay any hidden fees.

Structure: Costs + Processing Fees

Get the Gravity newsletter for the latest FAQs, tools, tips and tricks

Flat Rate

You pay one flat rate for every transaction. All the fees mentioned above are included in this flat rate. You’ll see this pricing structure most commonly used through Square. Depending on the situation, Square can actually be a good solution for very small businesses with very low average tickets that don’t need human support. In fact, we let business owners know when Square or any other solution could be better for them. Ultimately it depends on the individual situation, but we don’t typically like to take a one-size-fits-all-approach because every business is unique.

Structure: Processing Fee (% of sale) + Transaction Fee

Tiered Categories

You are charged predetermined rates based on the card type or risk of each transaction. The rate is commonly referred to as a tier and is usually categorized as qualified, mid-qualified, and non-qualified.

Whether you’re new to accepting credit cards or want to switch to a partner you can trust, we’re here to take care of your business’ unique needs. Sign up today!