For many businesses, credit card processing fees are one of their largest expenses.

Because there are many types of credit card processing fees, it can be difficult to figure out exactly how much you’re paying and why.

At Gravity, we try to simplify this process as much as possible, primarily by offering your business a fair and transparent credit card pricing model.

What is a Credit Card Pricing Structure?

A credit card pricing structure is the way a payment processor charges the merchant for the different types of credit card processing fees.

There are two types of credit card processing fees that are out of the payment processor’s control:

- Card brand fees: these fees are charged and set by the card brands (Visa, Mastercard, American Express, etc.)

- Interchange: this fee is paid to the bank that issues the card. It represents the largest portion (usually 70-80%) of your processing costs.

Together, these two credit card processing fees are called “wholesale fees” and they are set by the card brands and card-issuing banks.

Then, we have processor fees: these are the fees your processor (such as Gravity) charges for the services it provides.

The credit card pricing structure your payment processor uses determines the total cost of all of the credit card fees combined (wholesale fees + processor fees).

The 3 Types of Credit Card Pricing Structures

There are three main types of credit card pricing plans that payment processors use: cost-plus, flat rate, and tiered.

Cost-Plus Pricing

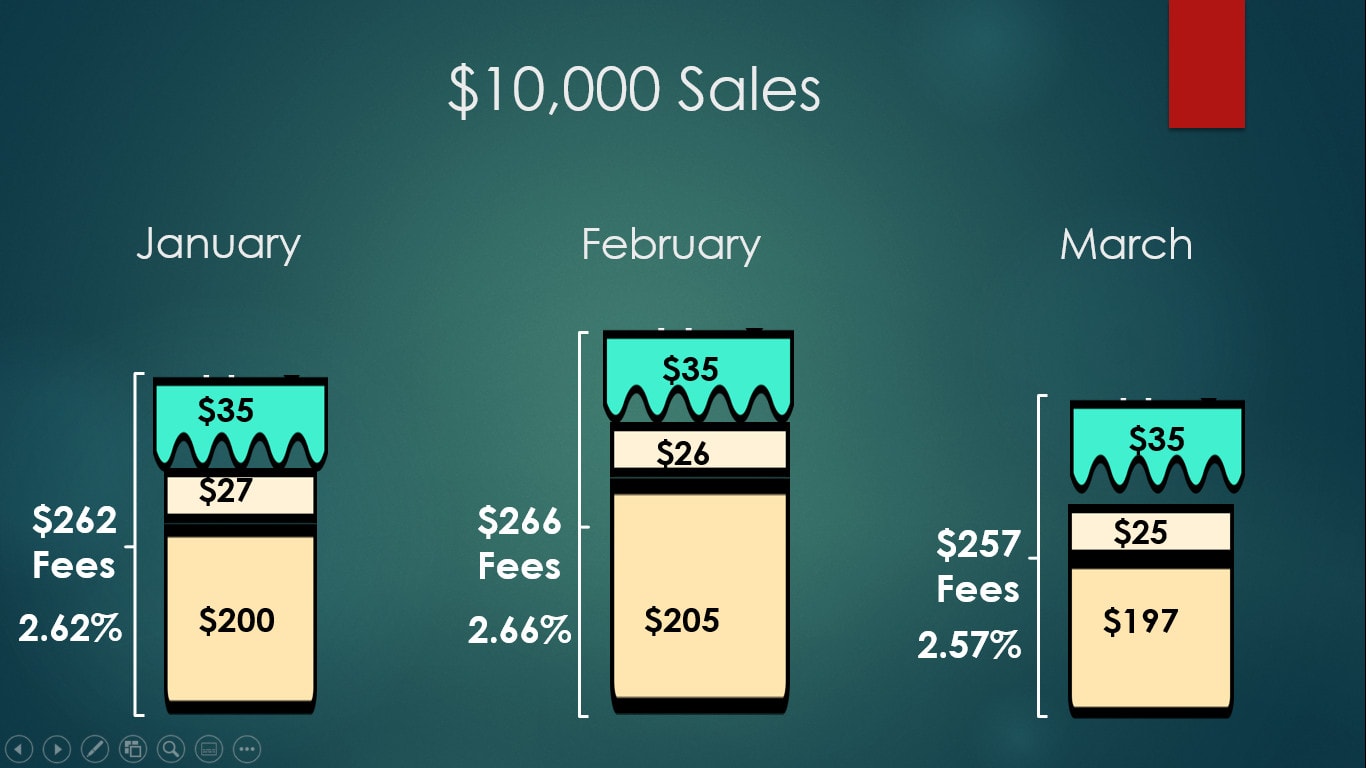

With a cost-plus pricing structure (also called “interchange plus”), you pay the wholesale fees the payment processor is responsible for collecting on behalf of the banks and card brands, as well as a flat fee to cover the services provided by the processor.

This is Gravity’s preferred credit card pricing structure because it provides the most opportunity for cost savings and the most transparency.

Because card brand and interchange fees vary depending on what types of cards you accept, the amount you pay each month will likely fluctuate.

You can see exactly how much you’re paying in each type of fee because it is broken out on your monthly credit card processing statements.

Example of cost-plus pricing model over three months of $10,000 sales.

Flat Rate Pricing

A flat rate pricing model is exactly what it sounds like.

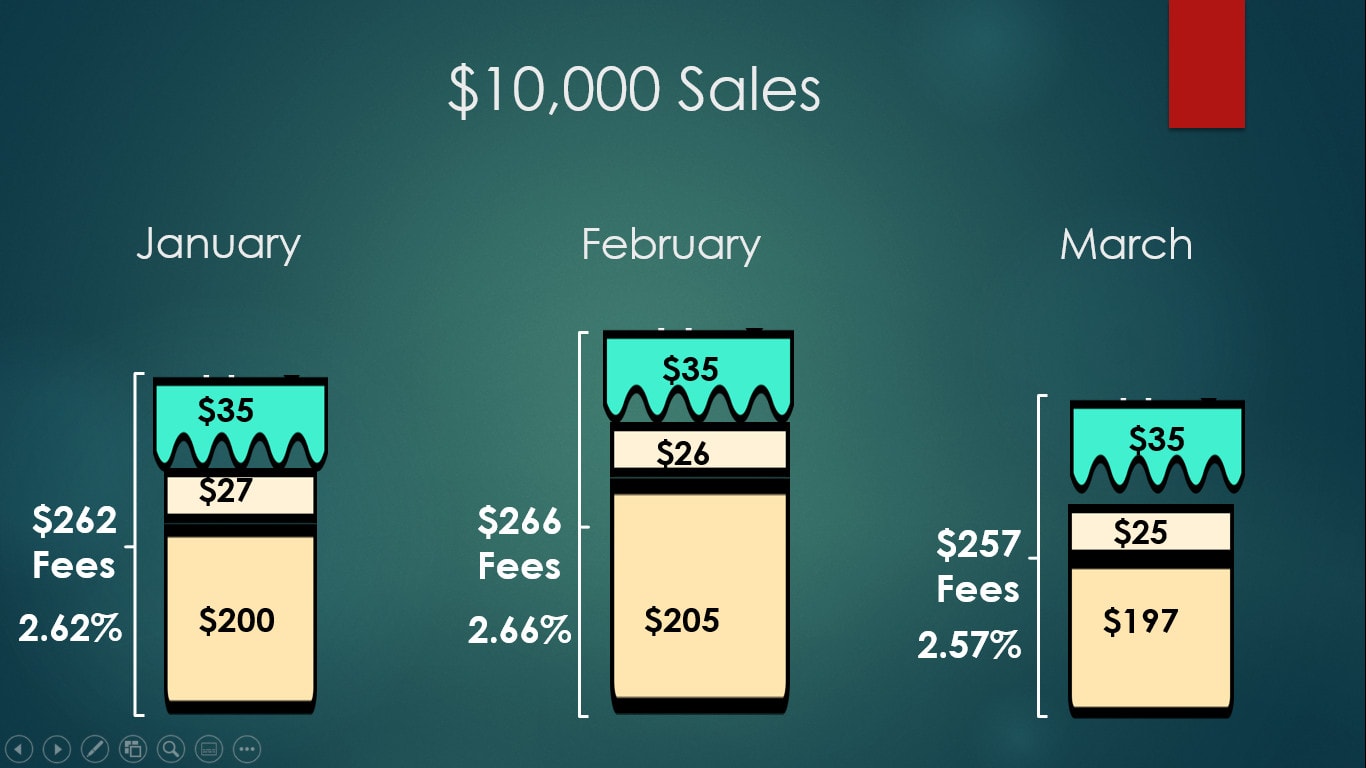

Instead of paying a different rate every month depending on your wholesale costs, your payment processor will charge you a flat fee each month that covers all of the different fee types.

This is a good option if you value consistency, but since the rate doesn’t change, you could lose out on some of the savings you would have under a cost-plus pricing model.

Example of flat-rate pricing model over three months of $10,000 sales.

Tiered Pricing

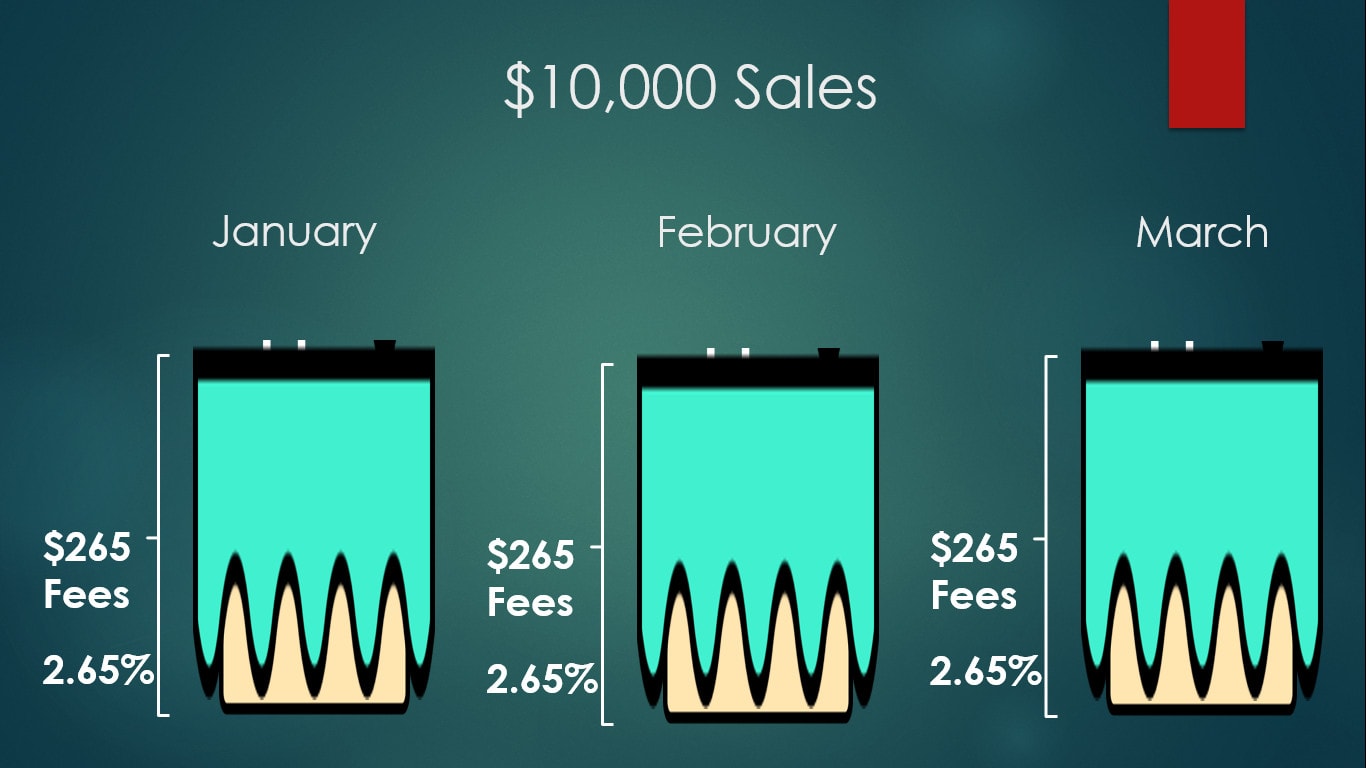

Under a tiered pricing model, your processor sets different rates depending on the types of cards accepted.

Because every processor is different and there are no standards dictating what types of rates can be charged for each type of card, processors are able to charge you way more than necessary for certain card types.

To make matters worse, many processors advertise a very low rate that applies to certain cards without telling you how much they charge for the other types of cards your business likely accepts.

Gravity does not use tiered pricing models for its clients, but many other processors do.

Pros and Cons of the Different Credit Card Pricing Structures

To summarize, here are the pros and cons of the three main types of credit card pricing structures.

| Pros | Cons | |

| Cost-Plus Pricing | -Transparent -Cost savings |

-Can be complex -Monthly costs fluctuate |

| Flat Rate Pricing | -Consistent and predictable monthly costs | -Can be more expensive -Less transparent |

| Tiered Pricing | -Simplicity | -Can be much more expensive -Least transparent |

Which Credit Card Pricing Plan is Best?

This depends on different factors such as your business type and your transaction volume. Ultimately, the best credit card pricing model is the model that results in the lowest effective monthly rate.

Under a cost-plus or flat rate pricing structure, you’re likely to pay an effective monthly rate of between 2% and 3% (maybe a little higher depending on the type of business you run).

But under a tiered model you might pay as high as 7% because of all the extra fees tacked on.

If you have any questions about the type of pricing model you’re on and/or want to consider a different pricing option, give us a call at 866-701-4700 – we can help you evaluate your options.

By Ashlie Blaske, Business Analyst

This post was adapted from “Credit Card Processing 101: How to Understand Credit Card Pricing Structures,” part of the free Gravity Talks webinar program.