At Gravity, we work directly with small and midsize businesses to help them process credit card payments. As such, we’ve witnessed firsthand the effects recent shutdowns and restrictions have had on these businesses since the outbreak of COVID-19. We wanted to take a moment to share some of that impact here and point out that, while this epidemic has devastated our small business community and we still have a long way to go before our economy fully recovers, there are some reasons to be optimistic.

At Gravity, we work directly with small and midsize businesses to help them process credit card payments. As such, we’ve witnessed firsthand the effects recent shutdowns and restrictions have had on these businesses since the outbreak of COVID-19. We wanted to take a moment to share some of that impact here and point out that, while this epidemic has devastated our small business community and we still have a long way to go before our economy fully recovers, there are some reasons to be optimistic.

First, the bad news. In the last three weeks, the 20,000 businesses we serve have lost a total of $730 million. And since our revenue depends on that of our clients, Gravity itself has lost more than $1 million–roughly half of our expected revenue for this period. One note on the data: since we only process credit card payments, our numbers do not account for any cash sales.

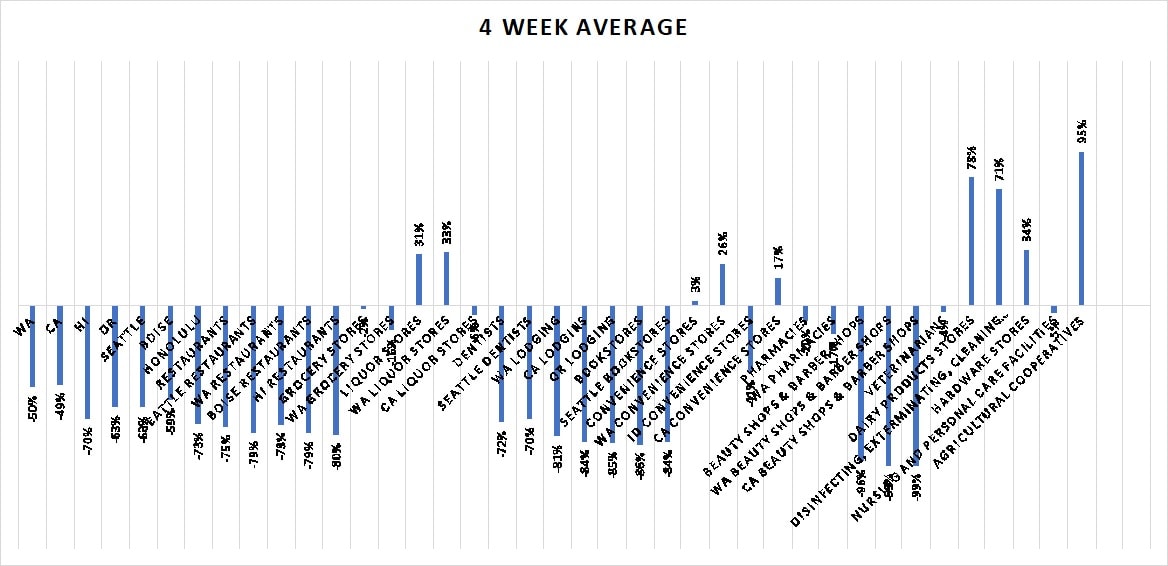

As you can see on the chart below, some industries have seen an especially steep decline in sales. Bars and restaurants–which make up roughly a quarter of our customer base–are down 75% overall since mid-February. Bookstores are down 86%, dentists are down 72%, and beauty and barber shops are down 96%. Even grocery stores, which are considered essential businesses, are down overall. Despite an initial surge in sales in early March and increased demand for certain products, their revenue is down 2% from before the outbreak and 32% from this time last year.

Figure 1: Sales Trends Across Industries

For other industries, geography seems to be a factor. For example, convenience stores in Washington State and California are up 26% and 17%, respectively, since the start of the outbreak, while those in Idaho are down 41%. In other sectors, increases in demand at the start of the outbreak have offset losses later. For instance, veterinarians saw an 8% increase in March as people reportedly rushed to adopt pets. Though their business has decreased slightly since then, they are down only 11% from last year. Pharmacies, meanwhile, are down only 1% from last year, thanks likely to a sharp increase in revenue during the first few weeks of the outbreak.

Not all businesses are suffering, though. Some industries are seeing a huge uptick in business as consumer shopping habits have shifted. Unsurprisingly, nursing and personal care facilities are up 113% from last year, while cleaning services are up 56%. Dairy product stores and agricultural co-ops that provide home delivery are up 87% and 95% from last year. As people turn to DIY home repair–either out of necessity or because they have extra time on their hands–hardware stores are up 18% since last year and 34% in the past two months (though some of the more recent increase can be attributed to seasonal changes). And with bars shut down, liquor stores are seeing a 31% spike in sales since the outbreak began.

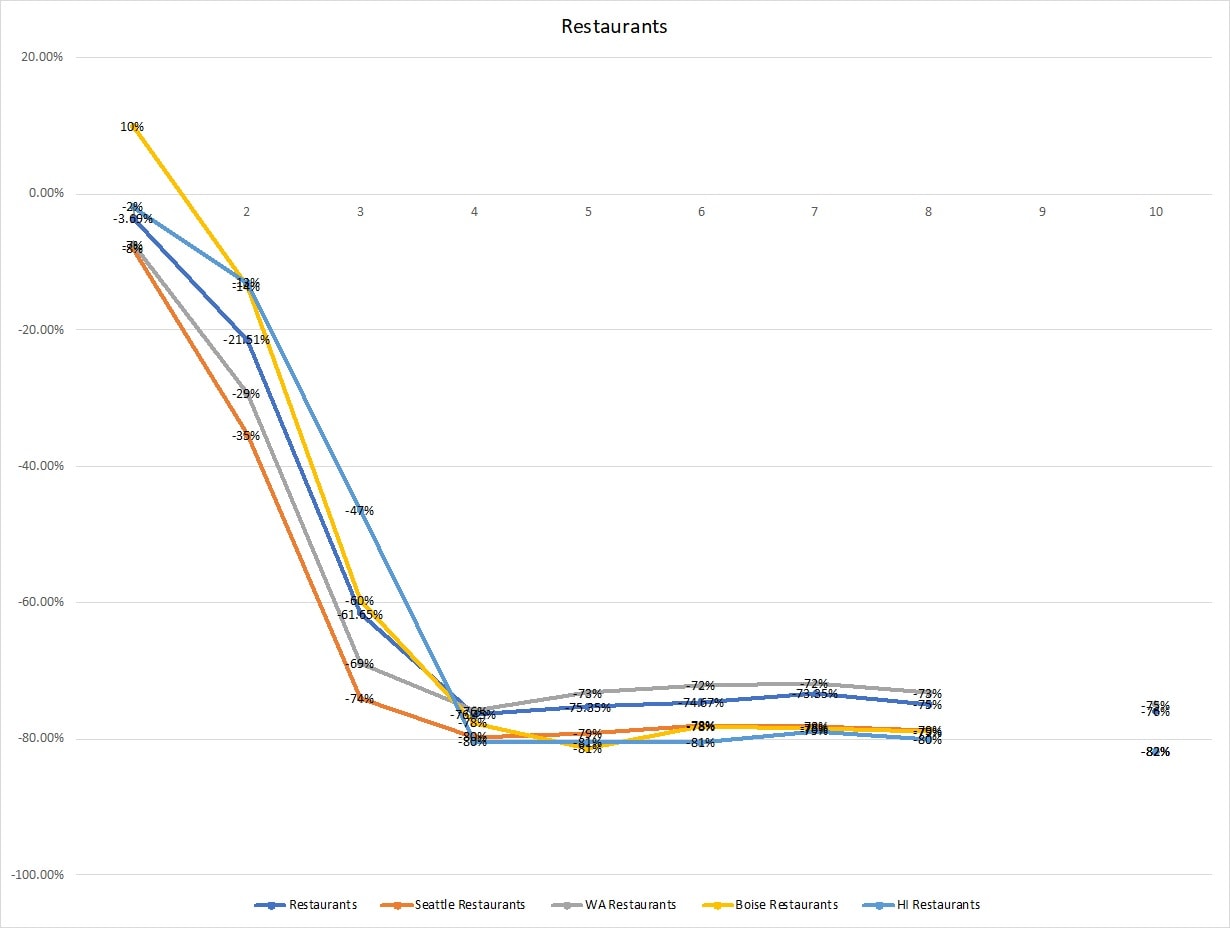

As we look at the overall data, a pale silver lining begins to appear. Although many businesses have been hit hard, the decreases seem to have leveled off. For example, while restaurants saw massive week-over-week slumps in the first few weeks of March, they’ve been processing roughly the same weekly revenue for the past month. (See Figure 2.)

Figure 2: Restaurant Sales by Location

We see this leveling off playing out in pretty much every industry that has shut down or been forced to cut back services because of the virus. Essential businesses like grocery and convenience stores, meanwhile, are seeing more volatility. For example, convenience stores were down 6% the last week of March but up 12% two weeks later. Nursing and personal care facilities, which, as mentioned are up overall, saw a 43% decline during the last week of March and a 67% uptick two weeks later.

Of course, aggregate data only tells part of the story. Some businesses have been forced to close their doors for good, while others have made dramatic changes to their business models in order to stay afloat. We’ve heard from bridal shops like Adore Bridal & Speciality in Morton, Illinois, who have moved their business entirely online, to restaurants like Musang in Seattle, who have shifted their operations to serve as a community kitchen for families in need.

If you’re a business owner, we hope this data provides some useful insight to help your business prepare for the weeks and months ahead. We need independent businesses more than ever and are here to help you find solutions that can make your business leaner and more efficient, both today and long into the future. If you want to learn more, check out our merchant services page or contact us at 866-701-4700. And if your business has pivoted successfully, we’d love to hear your story. Contact Brooke Carey, our lead storyteller at [email protected].

By Brooke Carey, Lead Storyteller