Accept Payments Anywhere, Anytime

Tailored solutions for the way you run your business, and the support you need to grow.

In-Store

Elegant countertop and portable handheld solutions designed to support the flow of your business.

Online

Full-suite e-commerce solutions that enhance the online experience, with rates that you won’t be able to walk away from.

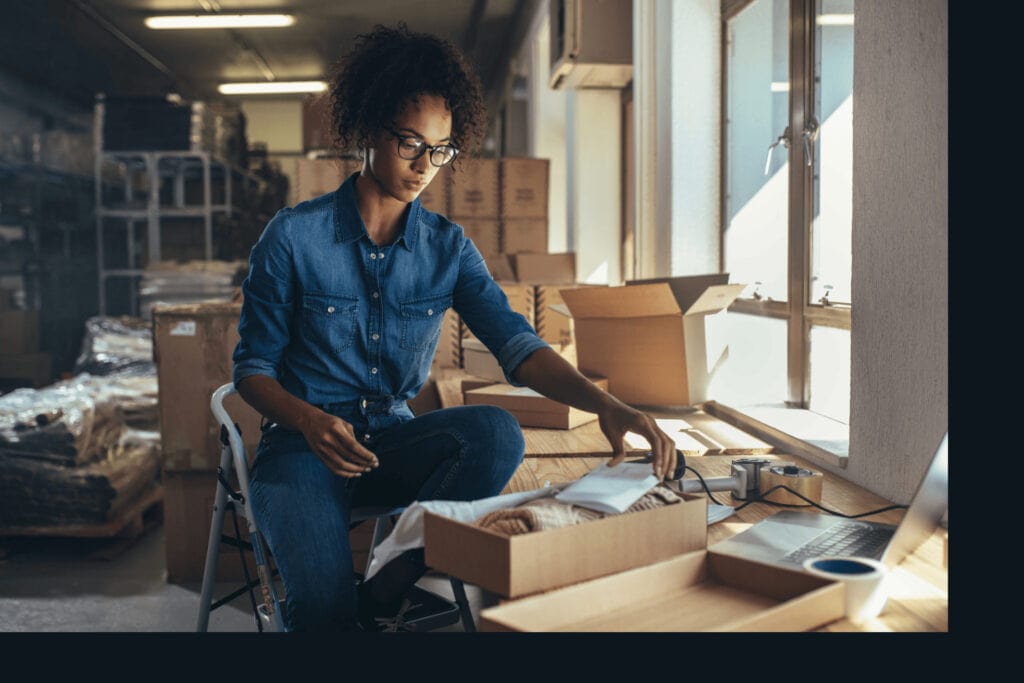

On-the-Go

Powerful mobile payments hardware and software that empowers you to take payments wherever you do business.

Payment Methods

Robust payments solutions uniquely adapted for your individual and industry needs:

- Modern Devices (NFC, WiFi and Cellular)

- Integration-ready platforms

- Full suite e-commerce solutions

- Easy-to-use Payments Dashboard

Devices We Support

Reliable hardware to support your business today – and as you grow.

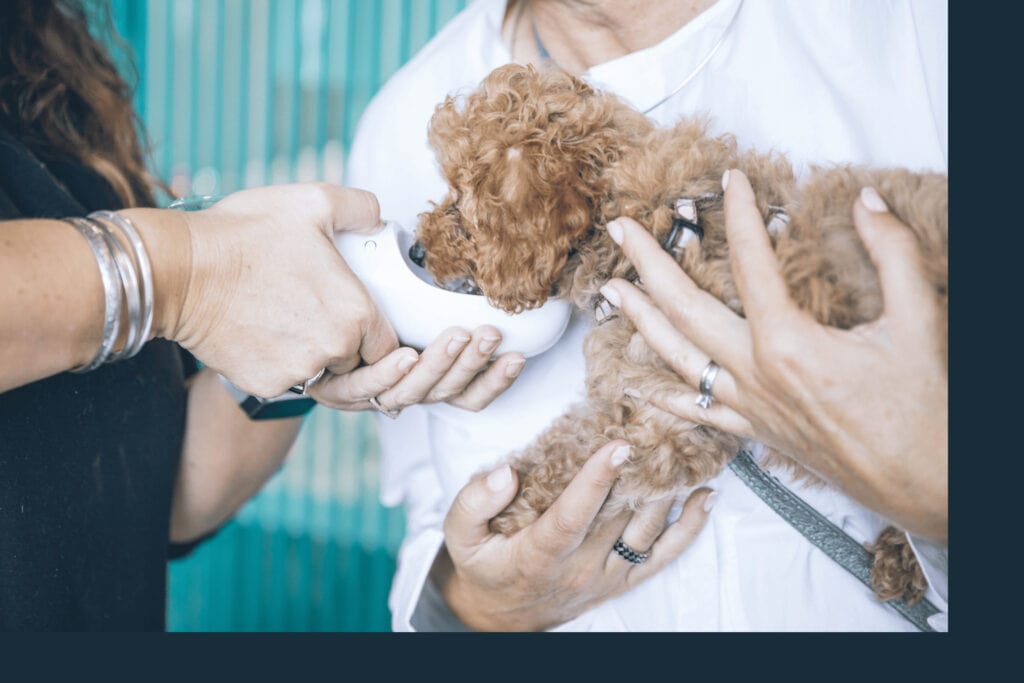

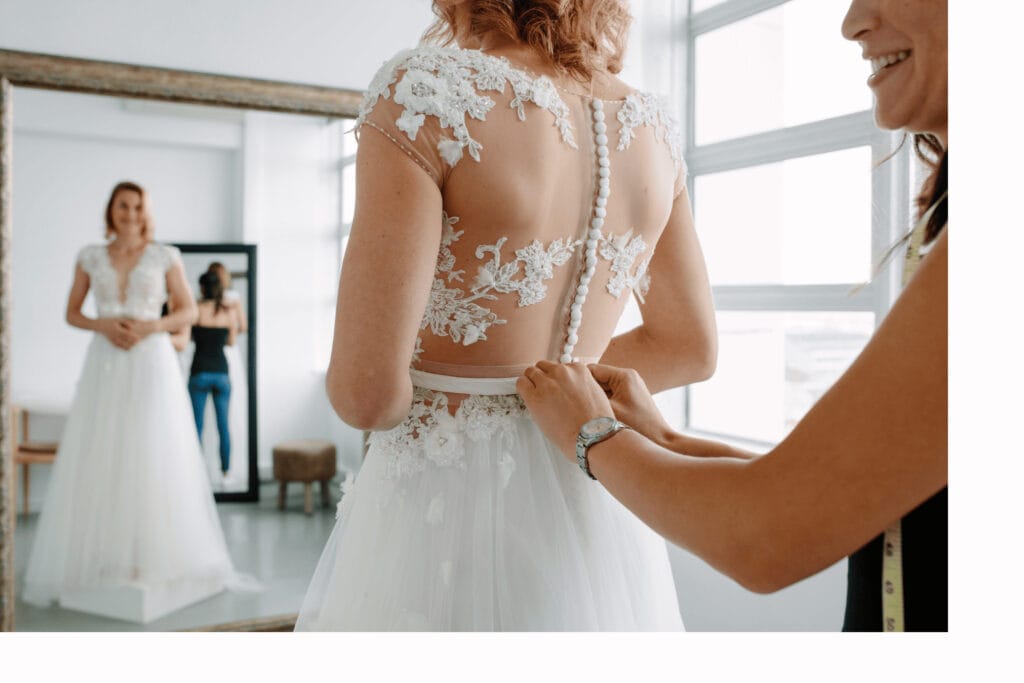

Who We Work With

Trusted and supported by business owners like you:

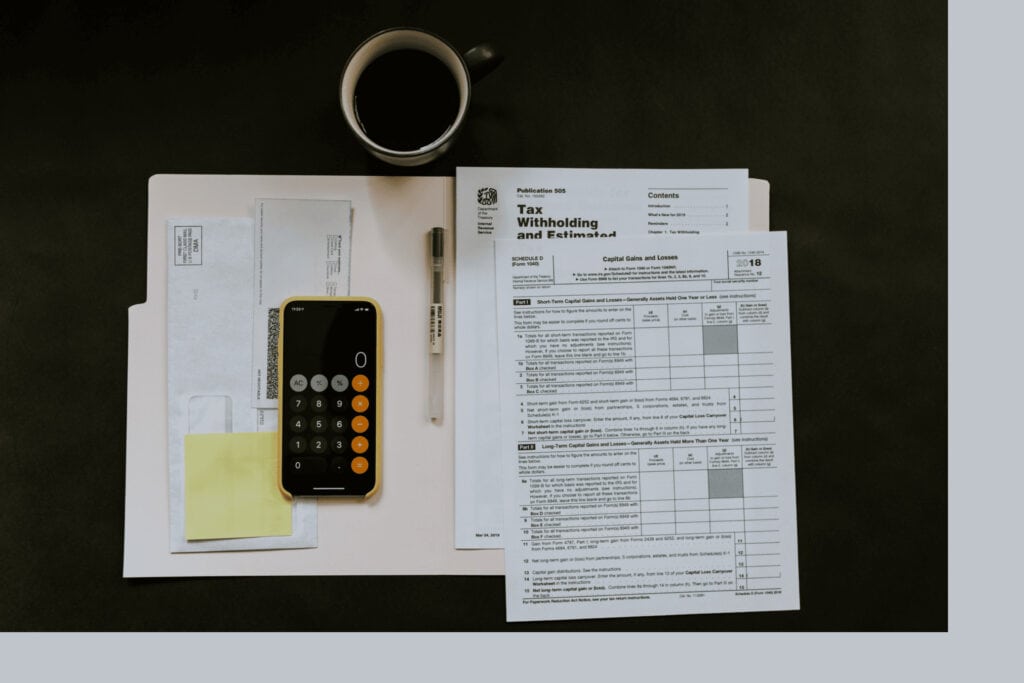

Review your Current Rates

Use our Rate Calculator to get a high-level overview of your current payment processing rates, called an “effective rate”.

This shows the average percentage of fees associated with each transaction.

If your effective rate seems high, get a free in-depth rate review with one of our consultants.

Get a Free Rate ReviewWhy Merchants Stay with Gravity 5x Longer On Average than Everyone Else.

Purpose and People Above Profits

Inside and out, we’re a company committed to positive change. That means a radical level of care for our merchants and our team.

Adaptable Solutions

Run your business your way – we’ll tailor a unique solution to help you grow properly.

Backed by Powerful Tech

Our solutions are fast, scalable, and versatile – take payments your way.

Real People, Real Support

Rely on 24/7 multi-language customer support within an average wait of 36 seconds.

Serious Security

Your business and customer data is secure with us. We’ll help you become PCI compliant.

Get the support you need to help your business thrive.

Developers

Leverage our full suite of integrated payments solutions to enhance your app or website – with hands-on support from our in-house team.

Partners

Let’s work together to broaden your reach, diversify your revenue, and better support main street small businesses.