As a small business owner, you probably get bombarded with phone calls, emails, or drop-ins from credit card processors all the time. They promise you the world and the lowest rates possible, but after you switch over, you might end up feeling let down.

This is one of the reasons why we at Gravity Payments are trying to change the industry by providing transparent rates, no hidden fees, and nothing hidden in the fine print.

To make sure you’re not being taken for a ride, you should know how to calculate your effective rate for payment processing.

This will help you figure out if you’re paying too much in credit card processing fees or if you are being offered too-good-to-be-true rates by your processor.

What is an Effective Rate for Payment Processing?

Your effective rate is your month’s total processing fees divided by your monthly total sales volume. It’s calculated as a percentage and can be found on your monthly credit card processing statement.

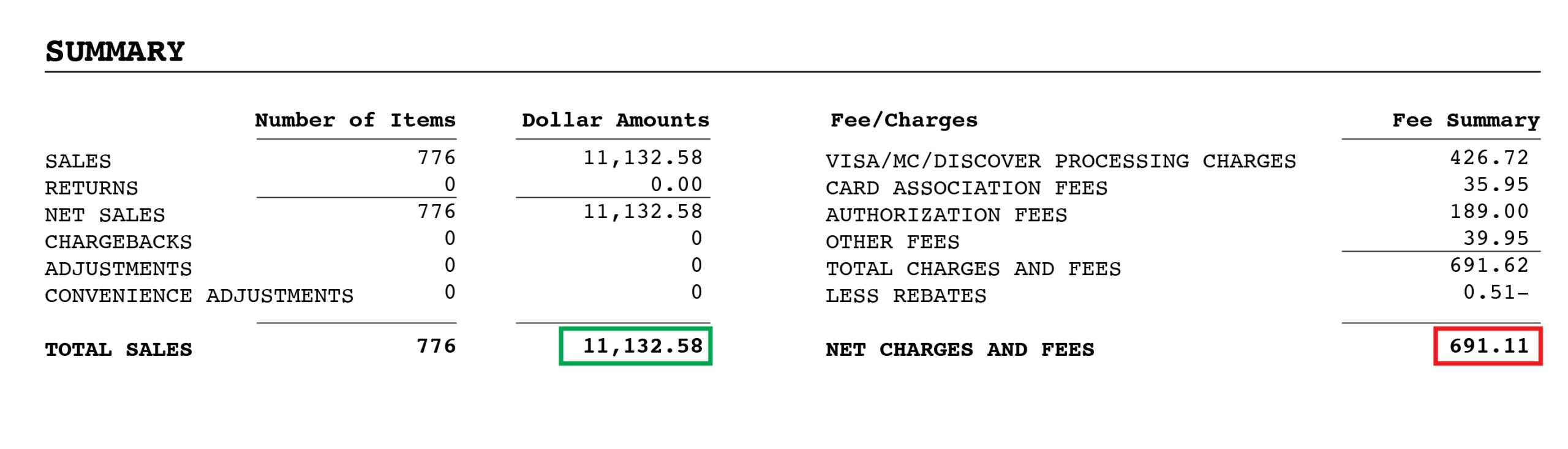

Let’s use the below statement as an example.

In this example, the business’s total monthly sales are highlighted in green and the total monthly processing fees are highlighted in red. So, how do we find the effective rate?

Remember, the formula to calculate your payment processing effective rate is TOTAL FEES / TOTAL SALES.

$691.11 / $11,132.58 = 0.06207 or 6.2%.

What is a Good Effective Rate for Payment Processing?

A good effective rate for payment processing depends on several factors, including your business type. For most businesses, a good effective rate for credit card processing is between 2% and 4%. However, there are cases where a higher effective rate can be expected.

To determine if you’re being overcharged, you need to find out how much you should be paying. In the previous example, 6.2% may be too much… or it may be just right.

Let’s take a look at the factors that determine your effective rate, starting with interchange rates.

What are Interchange Rates?

An interchange rate is the amount of money that banks and card brands (e.g., Visa, Mastercard, American Express, and Discover) charge. Interchange rates will vary depending on how you’re processing the card and what type of card is being processed.

For example, rewards cards and business cards typically have higher interchange rates.

The interchange rate is the portion of the processing cost that no credit card processor has control over. These rates remain the same no matter where your merchant services account exists.

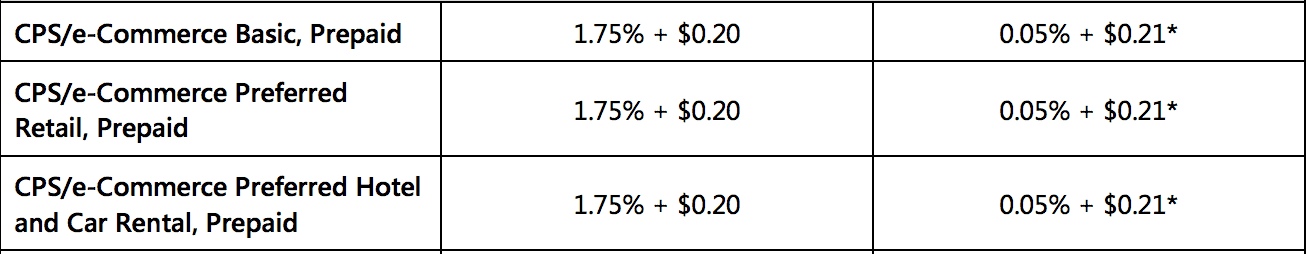

In this example, we’ll take a snapshot of Visa’s rates and imagine the above merchant is running an eCommerce business.

We’re seeing an interchange rate of 1.75% across the board.

That means the business’s effective rate is roughly 3.5 times the highest interchange rate. That should set off a red flag, as interchange fees often account for the majority of the effective rate.

Before drawing any conclusions, there are a few more things to consider in order to determine if your effective rate for credit card processing is too high.

Is Your Business Considered High Risk?

There are a few business types and industries considered high risk, including adult stores, casinos, and marijuana dispensaries. A business is typically categorized as a high risk due to a high instance of chargebacks, excessive fraud, or having bad credit.

If you’re considered a “high risk” business by your processor, you’ll likely incur higher rates.

Get the Gravity newsletter for the latest FAQs, tools, tips and tricks

Are Your Transactions Being Downgraded?

Pricing is structured in three different ways, but here, we only care about tiered pricing. In tiered pricing, you are charged predetermined rates based on the card type or risk of each transaction.

There are three different tiers: qualified, mid-qualified, and non-qualified. Many merchants receive unavoidable downgrades on their transactions based on things like swiping or “dipping” rewards cards or international transactions. A merchant can minimize its downgrades by making sure it passes on information like address verification or by submitting settlements.

Are There Hidden Fees?

You shouldn’t necessarily go with the processor who offers the lowest rates, as the deal may be too good to be true – a lot of fees may be hidden in the fine print.

This is one of the most common reasons effective rates are so high. Remember, the effective rate takes into account total fees, not just the interchange rate. Make sure you take a deep dive into each fee. If you’re not sure why you’re being charged for something, reach out to your processor.

If you’d like help or have questions on any fees (whether you’re a Gravity merchant or not), please feel free to reach out to our team! We’d be happy to walk you through your credit card processing statement.

Are There International Transactions?

It is possible that your payment processor is charging extra fees for international transactions and currency conversions. This can be a significant contributor to your total fees and can increase your effective rate.

Is Your Business PCI Compliant?

If your business does not meet the Payment Card Industry (PCI) compliance requirements, you may be charged non-compliance fees.

Check out our support page on PCI compliance for more information on how to become PCI compliant with Gravity Payments.

Do You Think Your Effective Rate for Payment Processing is Too High?

If there is no obvious culprit based on the above factors and you suspect your effective rate is too high, your processor may be overcharging you.

If that’s the case and you’re looking to switch, we’d be honored to earn your business. You can sign up today or contact our team if you have more questions.